With so much going on in the economy and the markets right now, my preferred investment strategy is to focus on a few ideas with high conviction rather than spreading my attention too thin with a broader approach. A high conviction idea to me is an idea I am willing to commit more time to researching and more capital to in the portfolio.

Going forward this year my two highest conviction investments are uranium and natural gas. It is incredibly hard to time anything in the markets and at the top of the list of difficulty is commodities. They are often counter trend plays that can sometimes lag the economy or precede big moves of the S&P 500.

A lesson I have learned from over a decade in the market is investing is never a sure bet; the best you can do is stack the odds as far in your favour as possible and wait for signs that you are correct.

Uranium

This has been on our radar for over a year now and it seems to be finally looking ready to blast off. We started a position in Feb 2021 and so far it is up 80.23%. In our view however this could just be the pregame stretch.

Why?

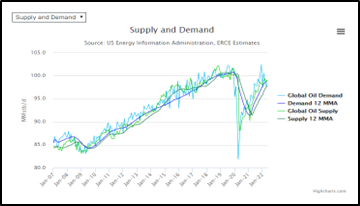

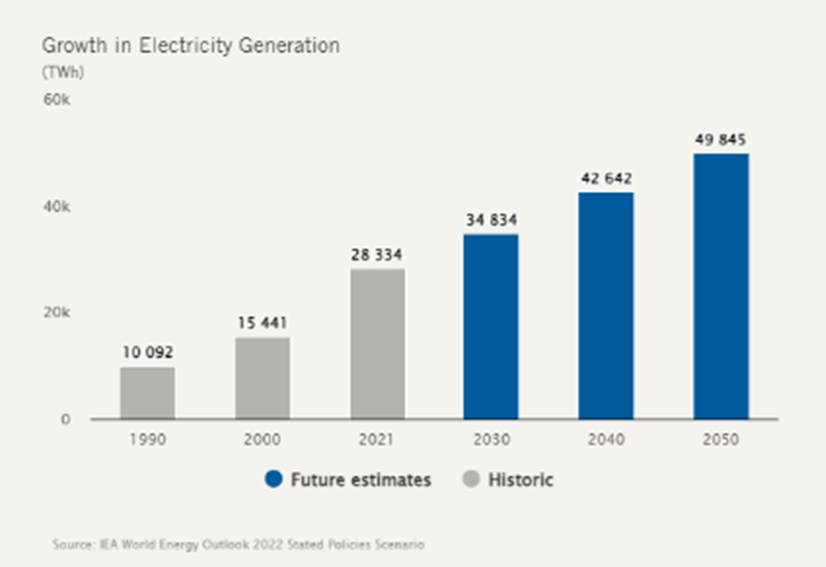

The world needs more power and there are a few billion people who want a quality of life closer to that which is experienced in wealthy countries. This requires energy; people are not likely to agree to live in a situation where their options are limited because it isn’t windy, or it has been cloudy for a few days.

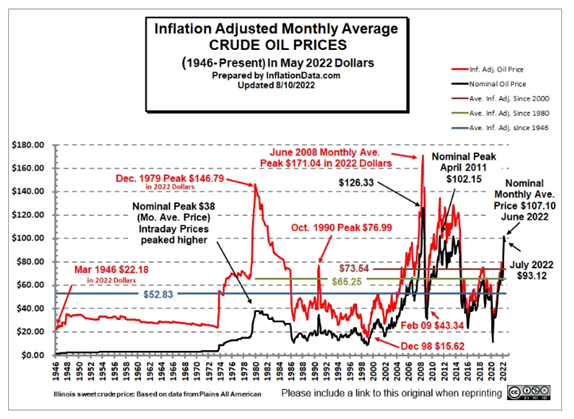

This increase in demand combined with the unintended consequences of ESG policy over the last 10 years has created a record amount of coal being used in places like Germany and California. Nuclear is the cleanest and most dense source of energy available and compared to the rising use of coal, it seems like a no-brainer. Reactors have started to make a comeback in Asia and the Middle East with China currently leading this adoption with 19 reactors under construction.

Uranium has been trading below the cost to produce it for years and the over supply is eroding. There are now physical trusts (U.UN) that are scooping pounds off the market and the energy companies are competing for pounds more than in recent history. When the supply glut runs out, this could be a huge move! Even if the price of uranium were to increase 10x from here, it is still such a small price compared to the billions to bring the reactors online that it almost doesn’t matter.

The investment I am using to try to benefit from this idea is U.UN.

Natural Gas

Natural gas requires a huge warning when discussing; people who trade commodities call it the widow-maker because of the huge counter intuitive moves it can make. The upside for this idea is seated in the energy argument along with a few others.

There is a huge spread between natural gas in the EU (10.11) and in the US (2.77) and as these two partitioned gas “economies” connect the price will move in theory to land somewhere in the middle. There is seasonality at play here too that helps as historically the price rises in the fall.

How am I wrong?

Uranium: If energy demand doesn’t continue to rise, this thesis will not play out. If there is another unfortunate event at a newish reactor, demand will fall off a cliff for safety reasons.

Natural Gas: If it acts like natural gas and defies reason, this might not win. Careful.

Good luck trading! (These are not recommendations. Look into these two ideas yourself! This is just what I am doing.)