Fossil fuels touch almost every part of our lives from energy production, as an input of a product, and a primary means through which everything is transported. Cosmetics, plastics, fertilizers, fuel, cleaning products and clothing represent only a few of the goods made directly with oil. In the last 150 years peteroleum products have revolutionized how almost everything is done resulting in an ever increasing need for oil.

Currently in Canada we consume approximately 1047 gallons per person per year. Many other large nations, India and China for example, remain far behind this number but are catching up quickly. These two countries at 51.4 gallons and 137.8 gallons respectively will only continue to increase their consumption as their GDP continues to rise and their citizens begin to enjoy a higher quality of life.

Energy is essential for growth and prosperity, but it comes at a steep price paid by the environment and our public health. These issues need to be addressed but unfortunately it is not reasonable to turn off oil before there is something viable to replace it. Currently many countries that have jettisoned fossil fuel sovereignty for dreams of becoming greener are paying for that choice. Germany is at the forefront of this energy crisis having shut down nuclear plants in favour of relying heavily on solar and wind power. Ironically unless they abandon plans to close their reactors down, they will be burning coal for the next two years to offset their energy woes. This story is ripping through Europe with France as the exception.

Why is there a problem?

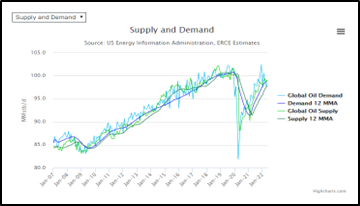

We have under invested in energy creation in the last ten years. It has been seen as undersirable and harmful to have E & P companies on the investment sheets of funds and ETFs not only due to its bad reputation but also because the cost of capital has been much higher for companies because of ESG regulations. This is simple supply and demand; demand will continue to grow and supply is far behind and slow to adjust.

It can’t go higher because it will break everything!

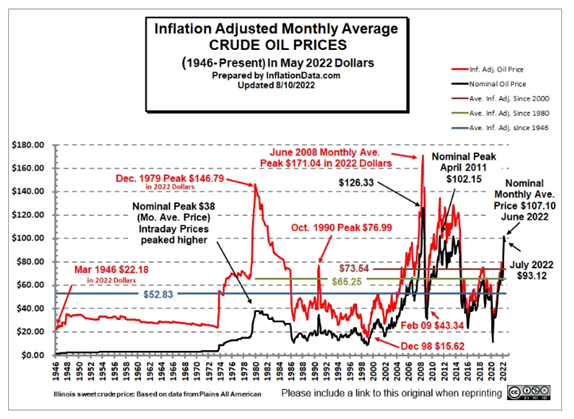

Currently oil is high but if adjusted for inflation, it doesn’t seem so extreme. It is hard to not just see the pump price and compare to past prices, but what doesn’t usually factor in people’s thinking is what the purchasing power of their dollars was when oil/gas was lower. Even near $100/barrel, we are not that close to “all time highs”; oil can go much higher before anything breaks.

How am I wrong?

Knowing what will destroy your thesis is crucial to not blowing up your trading account. One way my forecast will be incorrect is if there is a large and long recession in the US and Canada. A short-lived recession will not be enough to destroy demand to a level where there is extra supply. Even emptying the SPR (Strategic Petroleum Reserve) to its lowest level in 30+ years could not stabilize supply and demand.

Prediction:

WTI will be $125 by Christmas and $150 by March 2023.

Oil companies, leaps on oil ETF and the same for uranium is how I am playing this.