After my worst year in the books (+9.2%) since 2014 (+5.25%), it’s time to regroup and plan for the upcoming year. Although 9.2% is positive, with inflation CPI at 7% and the S&P 500 up 28.7%, it’s hard not to be a bit disappointed. Here is a quick summary of last year followed by a rough framework that I will be using for 2022.

What worked in 2021:

- RIOT and HIVE screamed out of the gate early in the year only to trend lower with a bit of a bump in the fall then continued to lose value for the rest of the year

- BRK.b (Berkshire Hathaway) was quietly up 30% and is a position that I don’t need to worry or think about for many years

- UCO/U.UN have both increased around 30% since I added them to the portfolio and I will discuss my thoughts on oil and uranium in this year’s plan

- VCI (Vitreous Glass) continues to be my largest position and like clockwork continues to pay a huge dividend under the radar while also increasing in value

What didn’t work in 2021:

- NUGT and SILJ: These two leveraged ETFs both finished down for the year. I expected these to do much better than they did, but I came out about even because of selling at highs and buying at lows. Holding leveraged ETFs is a risky move; they can really turn against you quickly and the expenses require a good move up to break even.

- Hedges: I used hedges such as UXVY, FNGD and SPXS throughout the year. Hedging is a large part of my overall strategy, but with limited market access for large periods of time this year hedging cost a lot (approx. 12% of overall performance in 2021) with minimal benefit. If there had been a violent drawdown, I would be listing this in the ‘what worked’ section.

Looking forward to 2022

Already it’s a very different market in 2022. Talks of rate hikes and quantitative tightening have people thinking less optimistically and the same people who have called for the end of the financial system since 2002 are back at it and gaining a larger audience.

I wrote about inflation back in June and January of last year and that is still an important part of the puzzle for 2022. My thoughts haven’t changed on how to do well during periods of high inflation and I will continue to hold my gold, silver and crypto stocks.

My new additions to this strategy are oil and uranium. In the last few months these have done very well and the best part is I think they are just getting started.

2022 Ideas

OIL

While I agree with the move to green energy being best for the planet and essential for our long-term survival, to be successful the switch has to happen in a logical and gradual way. For the last 5 years, fossil fuel companies have been treated like tobacco companies with lending for oil exploration being non-existent and higher rates imposed on companies in the sector because they are not in line with ESG (Environmental, Social, and Governance) criteria. There are some interesting results of policies punishing carbon-based fuel that will make for potential returns.

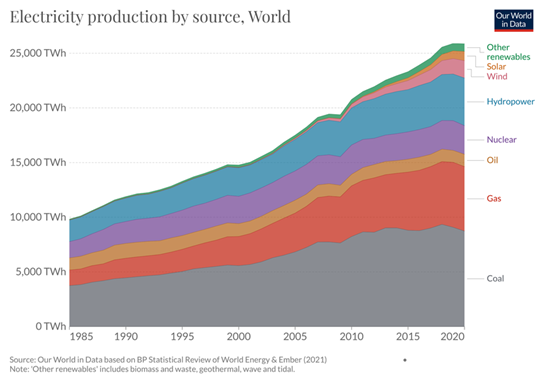

As more of the world increases production and consumption closer to North American and European levels, energy requirements will continue to increase. If supply can’t match this growing demand then the outcome is higher prices and shortages. The shocking part of this is that carbon based energy like coal, oil, and natural gas continue to grow despite other cleaner forms of energy being added. The demand is much greater than the offset of the renewables. A surprising instance of this is in California where almost 50% of electricity is currently produced using natural gas. This means that 1/2 of all Teslas driving around California are powered by natural gas.

In summary:

- reduced investment in production

- increase in demand

- geopolitical tensions growing

URANIUM

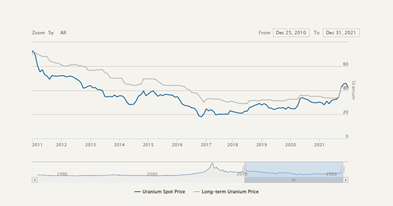

This might be my strongest conviction bet for the year. Playing off all the points from oil regarding energy use and need, uranium is in a unique situation. After the devastating disaster in Fukushima in 2011 many countries have slowly separated themselves from their nuclear programs. This has placed uranium in an awful position and the price has declined for the last decade because demand was lighter than supply. Currently the price of uranium is less than the cost to produce it.

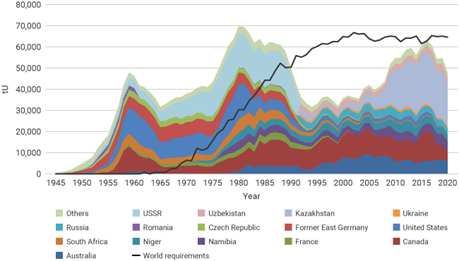

With next year poised to require much more energy than is currently available, it is my base case that nuclear will be part of the solution. Asia is leading the way with 55 reactors being constructed in mostly China, Russia and India in attempt to generate enough power and retire their mostly coal based power plants. I believe Europe and North America will follow if emission targets are to be met.

However, Uranium mines take a long time to come online. While it isn’t a rare metal, being able to extract it and supply it in its usable form is difficult. Three countries supply most of the world’s uranium (Kazakhstan 41%, Australia 13%, Canada 8%) and recent political unrest in Kazakhstan has energy producers concerned regarding future deliveries.

In summary:

- energy requirement is not currently possible

- uranium still isn’t worth the cost of mining it

- industry slow to turn on supply when it becomes profitable

To test and trade these ideas I am using U.UN (Sprott Physical Uranium Trust) and UCO. These are not perfect instruments but will directionally follow the price of the commodities.

VOLATILITY

There are too many reasons to list why this year will be volatile. My plan is to continue to hold a position that increases with volatility primarily through UVXY to benefit from instability. When/if the position reaches 15%, I will sell 5% and pour it back into positions I have high conviction in. I will rinse and repeat for all of 2022. If this doesn’t hit 15%, it will cause 2022 to underperform again; if it hits, this will juice returns.

I hope this summary and plan helps! Please read through the disclaimer on the site. This is my plan and may not make sense for others.

I hope we all crush it this year!

Josh