There are many ways to decide whether or not your investments are doing well. The goal most people are shooting for is a decent return without taking on unnecessary risk. With this in mind, you can measure your return against almost anything understanding that a good return and unnecessary risk mean different things to different investors.

Since I have a long-term investing horizon and am comfortable with what I consider medium risk, the S&P 500 is a great benchmark for me to measure my return against. Supposing I was unable to beat this benchmark, it would be super easy to just buy an ETF that tracks the S&P 500 and save myself a massive amount of time and energy. This is what I think is best for people with no time or interest to self-manage their investing. But for those of you with time to dedicate to managing your own portfolios, I encourage you to consider the S&P 500 as a key measuring stick to track the growth of your own return.

What is the S&P 500?

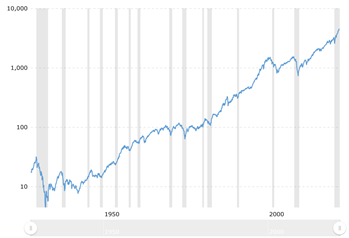

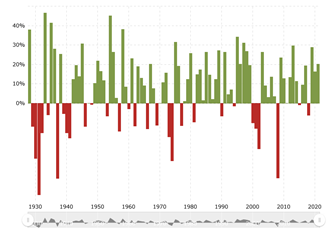

The S&P 500 is a market cap weighted index featuring the 500 largest companies that meet all of the inclusion criteria. The number of holdings changes when current companies issue multiple share classes or there are companies excluded/included to the index. It has returned approx. 10% annually and much higher in the last 10 years. Looking at the below charts showing the index’s history since 1930 it’s hard to imagine losing money just buying this index, but there have been a few rough patches with multi-year losing streaks.

Can you beat it?

Yes

Should you try?

Maybe (if you’re willing to put in the work)

Have I been beating it?

I thought you’d never ask.

Since 2014, the investing account shown below (LIRA – Locked In Retirement Account, Canada) is up 470% compared to the 185% of the S&P 500. I am unable to add or withdraw money from the LIRA, so it’s an accurate view of my actual investing results to date. For the first few years we were beating it, but it was close. Last year, we destroyed the S&P 500. So far this year, I started out ahead and over the last few months the S&P has outpaced me.

Will we always beat the S&P 500?

As recent months have shown, there will be stretches where the index outperforms Bush League; however, I am confident that over any multi-year period the correct move for me will be to continue to manage my own investing.

The case for managing your own investments

I like the ability to profit when the market goes down (it does sometimes), and I like the ability to allocate more capital to ideas I think will do better than the average or that I personally think benefit society. The S&P 500 is market cap weighted which means bigger companies have a bigger effect on the direction it moves leading to a small handful that steer the index (ie. FAANG+M). The perception of owning an index of 500 companies is that there is good diversification, but in my opinion there is much less than most people realize. The below image shows that when big tech has a rough day, the entire index follows.

So why compare?

Constantly keeping score against this index allows me to see what is working and what is not in my own portfolio. The S&P 500 is known as the “market”; if people say “the market” is up or down, they are usually referring to this index. If the market has been ripping for years and you are not making any money, comparing your results allows you to evaluate whether you are seeing things as they are or as you think they should be. If I had been stuck watching P/E ratios and complaining that everything was overvalued for the last 7 years, I would have missed what was happening in the market.

My assessment is that my portfolio will continue over long periods of time to beat the S&P 500. When it goes up my portfolio seems to do well and when it crashes, we are hedged so we stand to do very well. In the event I find the way I invest isn’t working compared to the S&P 500 then I will either adjust or buy the index and get a different hobby.

How does your portfolio’s results compare to the S&P 500?

2 replies on “Comparing Your Investing Results to the S&P 500”

Hey Josh,

Really enjoying your blog.

I was wondering what your take on the market conditions are this fall… allow me to discuss a little below.

It seems now that companies are starting to feel the effects of supply shortages from global trade. This includes extreme delays in shipping and sourcing from places like China.

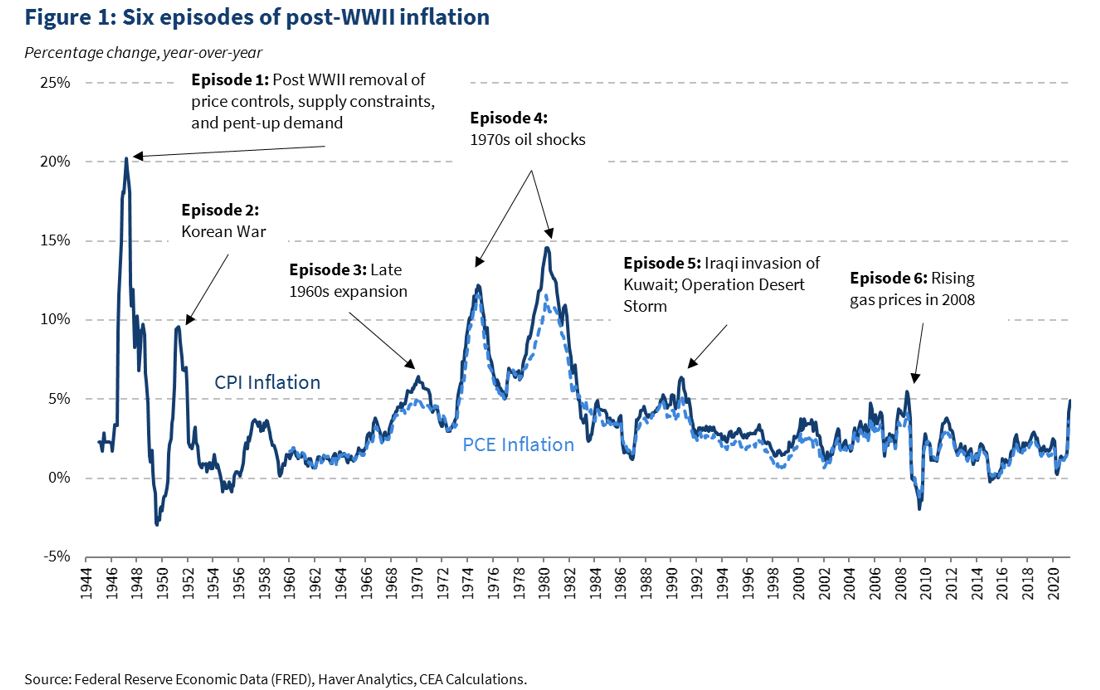

If this keeps up, would we not see a continued rise in prices? This, in addition to inflation, could make for an expensive year for consumers.

Moreover, historically what we see is people trying to secure their investments in precious metals – but it seems odd that precious metals have been following general market trends this last week.

What are your thoughts on the market this September? Is there a similar point in history we can study to learn more, or is this uncharted territory?

Appreciate your blog, love your insight, and don’t shave the beard.

Best,

Austin

Hey Austin,

Thanks for reading the comment.

As you know, my highest conviction trade this year continues to be silver. Unfortunately, it has also been one of my worst performing…I agree that people historically move into metals & real estate to benefit from inflation or at least lower the effects on an overall portfolio. The reason we haven’t seen the metals move much lately is unclear to me. It could be a mix of some of the following factors:

• Gold and Silver had nice runs in 2020. Gold moved from $1240 in 2019 to > $2000 in July of last year.

• Some of the volume is being soaked up by cryptocurrencies.

• It is just consolidating and will break out soon.

• The entire market is a scam controlled by lizard people who bathe in gold and silver while watching Ellen (saw this on reddit).

• Things could be different this time or I have missed something big.

I don’t really have strong directional conviction for Sept *we are currently half done already. I think it could continue to be more of the same. Volatility seems to be rising though, so a move one way or the other may be on its way. I am giving my metals until the end of the year to start moving. I am also adding some long volatility options each month as a hedge for the portfolio. If things go down quickly the options will offset the loss and allow me to buy more shares of the remaining positions. I could see a 10-15% correction this fall, but anymore and I think the money printers will fire up again.

In terms of historical analogs, I have added a few links below. There was quiet a bit of talk that might help on this week’s Market Huddle. The other link is to a different blog about times in history when inflation was similar. I suggest you overlay those dates with the S&P 500 and commodities etc. Things will be a bit different this time but there are always patterns.) might be different for you.)

I hope this helped!

Josh

(Remember I am not an investment professional, please investigate everything yourself before you make any decisions. Our positions and circumstances may be different so what works for me (or doesn’t