The market is currently frustrating both bulls and bears as we sit on a major resistance level that both sides are convinced we are about to break out from. I don’t really have a directional view in the near term, but am watching this level intently as it should be a violent move either way.

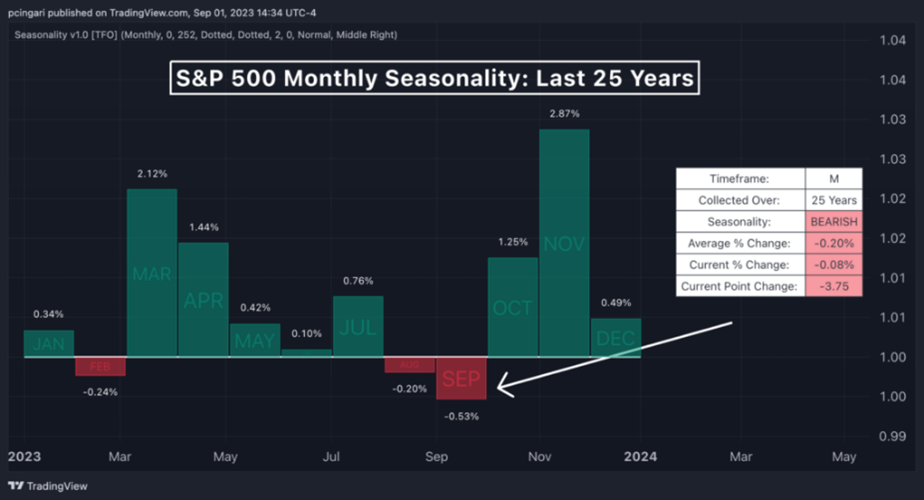

There are enough people pushing doom and gloom, so I don’t feel like I need to go into the negative case for a downturn. On the positive side, one of the more interesting arguments is a seasonal one. The market historically follows a few patterns one of which is that the 4th quarter is normally positive and usually the most positive. August and September are historically rough and October is known as the bear killer. I have seen a few “Uptober” posts already. We will have to see how this plays out, but it should be a big jump in either direction from here.

Follow the portfolio to see our reaction to how this directionally important crossroads unfolds.