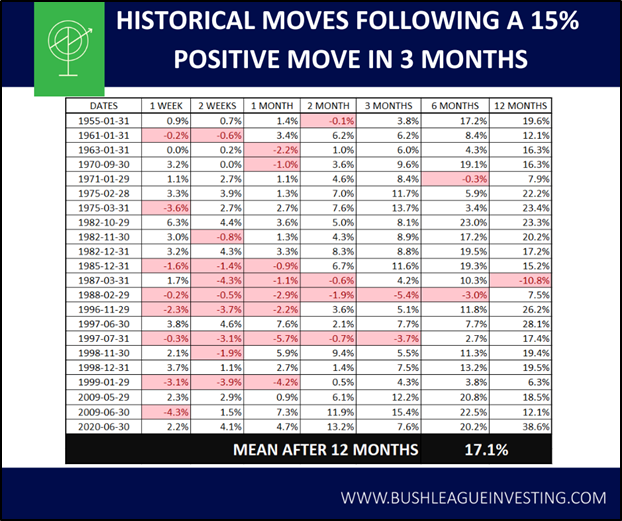

The S&P 500 has been on an absolute tear for the last 3 months. Investors are feeling both extreme FOMO and that we have stretched too far and the market is about to correct. Both interpretations are valid so to stop ourselves from making long-term decisions based on emotion, it is best to look at what has happened in the past after an epic rally like this.

As it turns out, the market has had a run like this 22 times since the 1950’s and 21 times ended up higher 12 months later. This is not surprising as the market normally goes up, but it’s important to note that even after big moves there are always more opportunities. Investors who completely sell off after big moves or who give up thinking they have missed out are destined to watch it keep going higher 95% of the time.

This doesn’t mean it can’t be down 12 months from now, just that the odds favour a continued push up.

I will continue to be invested and wait until the charts, fundamentals or macro screams it is time to get out.