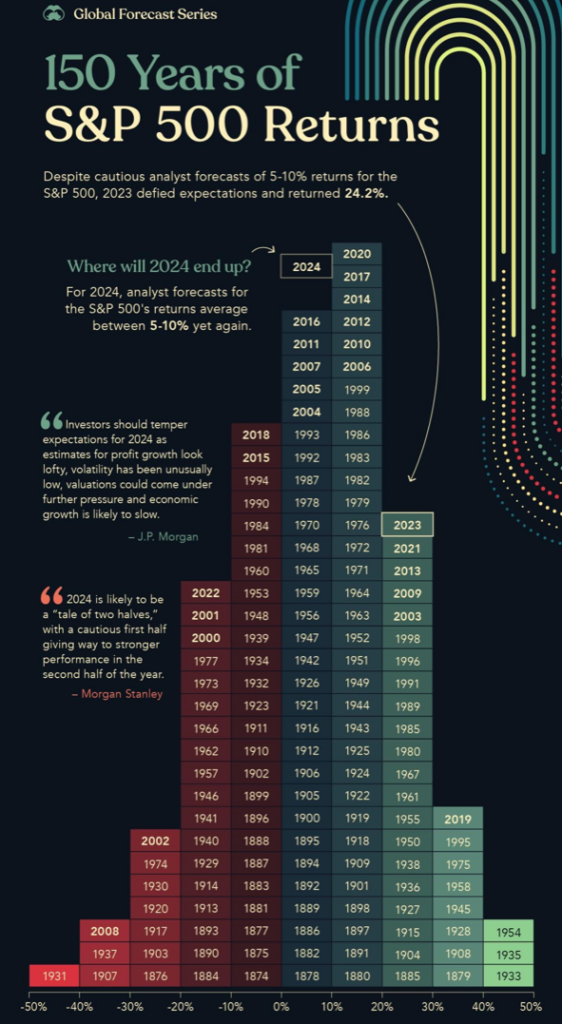

It is the start of another year and the investing world is struggling to find a narrative for 2024. For the 15th year in a row, the usual doom and gloom crowd is predicting that the financial system will collapse and the super optimistic few think this is the beginning of another super cycle with resonance to 1994. As in most things, the answer will most likely fall in the middle and will follow historical precedence.

To avoid falling into the emotional traps of fear or greed, a good place to start is looking at what has happened before.

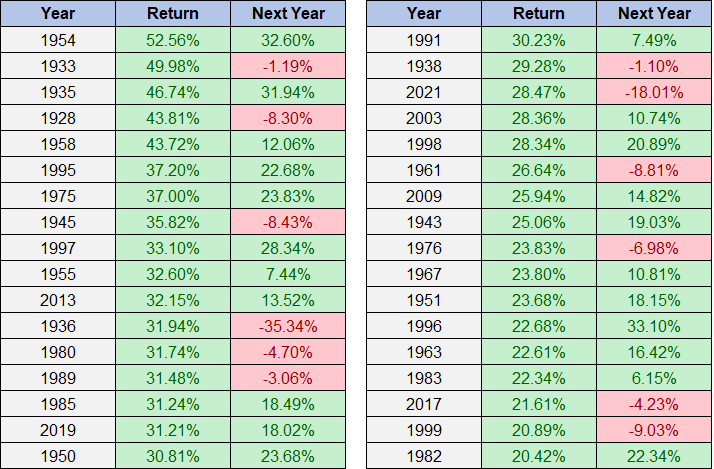

On average, the S&P 500 goes up approximately 9% a year so at the beginning of every year this is where I set my expectation. I balance my expectations by staying on top of current market developments but also through research and analysis of historical data points and patterns. For example, if we ask what to expect from the market after being up 20% (2023 was up 24%) an historical lens will show us that since 1928 the market has been up 22 out of 34 times the year after a 20%+ year. Some other data points leaning in favour of an upcoming green year is that the 4th year in a presidential cycle is positive 75% of the time, and in cycles with a red mid term year, the market has been green 100% of the time. This info isn’t predictive but shows what has happened in similar situations in the past (source).

These data points are helpful for perspective and to remain grounded; they are certainly not screaming sell everything and hide your money under your bed.

With the context of past market behaviour, there are enough reasons to be both optimistic and cautious in 2024. I tend to highlight positive reasons and data here because negativity normally gets the airtime. 2024 is a hard year for market predictions but, luckily, no one needs to predict anything If we trade and invest in what we see and not what we hope or fear we will see, we will be much less likely to make an emotional trade we regret. I will continue to own shares in companies I believe are great and hold them until I have a reason not to. If the market starts telling us that it is headed down in a big way, I will sell 25-50% of my shares in these companies and wait until I can see a game on sign in the charts and earnings to jump back in.

Come back next week for my best ideas for 2024.